Is Crypto Dead? An Update On The Current Cryptocurrency Industry and Market

In the ever-evolving tech cosmos, a consistently trending topic has been the subject of the same fascination and skepticism as the Internet’s inception: Cryptocurrency. The remarkable journey started with Bitcoin, a digital blockchain phoenix that emerged from the ashes of all that is wrong with financial tradition.

But we know that Bitcoin is not alone in this odyssey. Many other crypto assets like Ethereum have also taken a role in solving different aspects of the same issue: giving you control over your money. So far, the crypto story sounds idyllic, but like any good story, it's filled with victories and downfalls.

While unsettling, stablecoin TerraUSD's tumble and the deception behind FTX's descent had nothing to do with cryptographic failures. Still, they sure made the corners of the community wonder if crypto was genuinely dead. Shortly after these events, we learned those mishaps don't define the tenacity that underpins crypto assets.

As we navigate this chronicle—where data morphs into currency and algorithms rewrite fiscal norms—let's delve into why the influence of cryptocurrencies remains strong.

Understanding Cryptocurrencies and Their Role

Imagine money that wasn’t issued by a state, and it's encrypted and exchanged on a public encrypted ledger. That's cryptocurrency – virtual currencies powered by blockchain technology.

The pioneer Bitcoin started as a daring idea in a 2008 whitepaper by Satoshi Nakamoto. It aimed to be digital cash, a way to sidestep banks and their fees. But as Bitcoin gained followers, its purpose expanded. It morphed into digital gold, a hedge against inflation, sparking a financial revolution still unfolding.

After the launch of Bitcoin, other cryptocurrencies quickly followed suit, creating a diverse ecosystem. These alternative digital currencies, often referred to as "altcoins," aimed to address different needs of the crypto community. Today, these coins aren't just a digital substitute for cash; they're an investment, a way to earn passive income with programs like token staking.

The Evolution of the Cryptocurrency Industry

From the inception of Bitcoin's white paper in 2008, cryptocurrencies have been on a dynamic journey that rewrote the rules of finance. As early as 2011, the community saw Bitcoin being joined by contenders like Namecoin and Litecoin, each aiming to redefine digital value.

By 2015, Ethereum, driven by the visionary Vitalik Buterin, brought smart contracts into the picture, signaling a shift from mere currency to programmable assets.

As we entered 2020, the rise of crypto memes and the GameStop meme stock phenomenon further underscored the impact of these decentralized currencies on traditional financial norms.

This chronicle of innovation speaks to the relentless spirit that's driving the evolution of cryptocurrencies, ushering in an era where economic empowerment is genuinely decentralized.

The Bitcoin Boom

Bitcoin's impact on the crypto world reverberates far and wide. Solving the double spending problem laid the bedrock of trust, enabling users worldwide to define and agree on value. It revolutionized ownership, freeing assets on networks like Ethereum.

Beyond this, it catalyzed a financial renaissance, offering a direct, decentralized transaction alternative with many functional tools. This shift disrupts traditional systems, championing transparency and empowering individuals over hidden investment scams.

Bitcoin's cross-border accomplishments remain untapped, offering promise regarding savings and financial efficiency. Moreover, it triggers digital autonomy, sidelining intermediaries and fueling an open application explosion. I

n a nutshell, Bitcoin is far from dead. Its influence extends beyond its original white paper’s purpose, shaping a new financial and digital independence era.

Emergence of Altcoins and Defi (Decentralized Finance)

Since the turmoil of a year that was 2020, also known in the crypto community as DeFi year, the cryptocurrency scene welcomed a great variety of altcoins, offering users a long menu of choices beyond Bitcoin.

All of these alternative digital currencies had unique features and purposes that shook up the once Bitcoin-centered crypto space. And if that wasn't enough, enter DeFi – the decentralized finance arena that's like the financial world's cool rebel cousin.

DeFi is all about kicking intermediaries to the curb and letting users play financial wizard without the hassle of traditional banks. So, whether you're into altcoins or DeFi, it's clear that the crypto landscape is not just about Bitcoin anymore.

Analysis of the Current Cryptocurrency Market

In the tumultuous year of 2022, the cryptocurrency landscape witnessed a sharp decline in the value of some of its most prominent players, marked by dramatic events that sent shockwaves through the community.

Among these seismic shifts were the failures of several stablecoins, including TerraUSD and Luna, casting a shadow over the stability of these supposedly reliable digital assets.

The cryptocurrency sphere was further rattled by the November collapse of FTX, underscoring the vulnerability of even established centralized exchanges. Amidst this backdrop of uncertainty, concerns about cybersecurity and the looming specter of potential regulatory measures added to the palpable unease among investors.

Market Trends and Patterns

This year, the crypto scene has been a whirlwind of shifts and surprises that ended up with a rather stable price for the king of the crypto marketplace, Bitcoin. Let's go over the pivotal patterns that have shaped the present market:

- Bitcoin's remarkable comeback boasts an 87% year-to-date performance, surpassing traditional financial giants.

- The connection between Bitcoin and traditional finance is at an all-time low, showing a new direction for the crypto future.

- New developments, like the Ordinals and Inscriptions, hint at exciting innovations for Bitcoin.

- While the global stablecoin market value dropped 7.0%, changes in how they're used and the rules they follow have reshaped this market. USDT's market share shot up by 25.8%, changing the stablecoin landscape.

- DeFi's story unfolds with liquid staking (https://liquidcollective.io/liquid-staking/)as the leading sub-sector. More people are moving to decentralized exchanges (DEXes), boosting DeFi's growth. Despite a 0.5% decrease in dominance, DeFi remains captivating in the crypto world.

- NFTs are buzzing, with trading volume in the first half of 2023 surpassing the last semester of 2022, driven by Blur marketplace (https://blur.io/). However, some NFT prices have dropped in the broader market this year.

- Gaming tokens are rising due to the market's recovery, with Apecoin (APE), Axie Infinity (AXS), Sandbox (SAND), and Gala (GALA) among the ones that registered the most significant price increases.

Joining tech and play, Provably Fair tech is also multiplying its reach and gaining adoption among game providers and players alike. As players bet, rewards grow thanks to cryptocurrencies.

Factors Influencing the Current Market

On a broader scale, the macroeconomic landscape has been scarred by inflation and economic recession, fueling the fire of doubt. As the traditional financial structures showed signs of fragility, a growing number of individuals sought refuge in the arms of digital assets.

In essence, a wavering trust in the stability of the U.S. credit system might fuel the fire of attraction towards a decentralized, boundary-defying currency.

Is Crypto Dead? Unraveling the Reality

The answer is no. Crypto is not dead. Despite the bumps and setbacks, the cryptocurrency world keeps evolving, showing that it can adapt to every economic climate. Bitcoin and other digital assets are still going strong, with Bitcoin's value soaring and innovations like DeFi and NFTs changing the game.

Statistics and Data on Cryptocurrency Usage

The image the audience has of crypto is constantly changing, and that becomes evident when we go through the latest reports on crypto adoption:

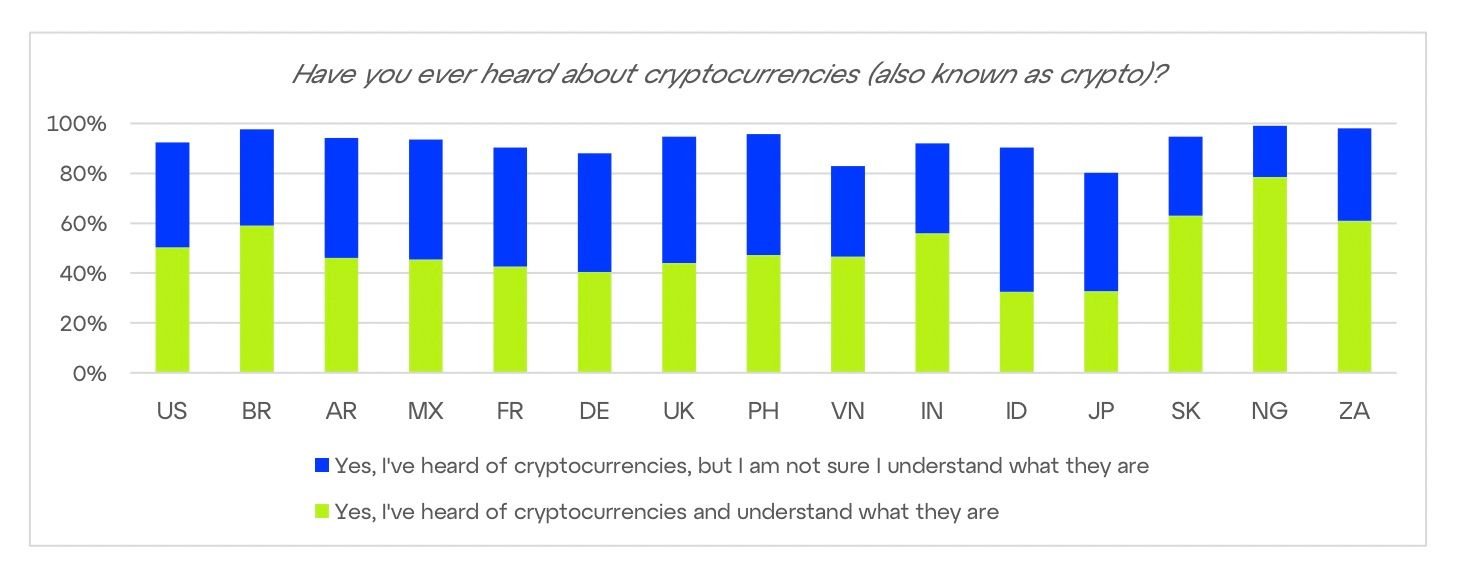

A staggering 92% of people globally are now familiar with cryptocurrencies, marking a seismic shift in digital finance understanding. Among them, half, approximately 50%, also confidently claim to grasp the basics. Notably, countries like Nigeria (78%), South Korea (63%), South Africa (61%), Brazil (59%), and India (56%) have seen impressive spikes in crypto comprehension.

However, Indonesia and Japan seem to lag, with only one in three individuals boasting knowledge of crypto specifics.

When it comes to breaking down these numbers by age and gender, the digital divide persists. Men aged between 25 to 34 years old lead the charge in understanding the crypto realm, while women and older respondents find themselves on the less informed end.

This trend echoes across most of the analyzed countries, underscoring the nuanced interplay between demographics and financial technology understanding.

*Image from Consensys Survey Global on Crypto and Web3

The Future of Cryptocurrencies

The community is pushing for more ownership and privacy rights. In the past, we’ve seen that negative stock trends could also bring down Bitcoin. However, the current situation is different: the decline of fiat-based economies isn't causing Bitcoin to plummet. Instead, it's showing resilience and holding its position.

This new trend suggests that cryptocurrencies are gaining independence from traditional economies.

Predictions and Projections for the Years to Come

The recent resurgence of interest among large investors, affectionately known as "Crypto Whales," is turning heads. Adding to the intrigue, the countdown to Bitcoin's halving event is now ticking, with less than 300 days left. This halving, a core feature of Bitcoin's design, directly impacts its deflationary nature by reducing its supply.

As history has shown, this scarcity often acts as a catalyst for the BTC price to climb higher. Bitcoin, renowned for its resilience, has an uncanny knack for bouncing back.

Despite numerous predictions from industry veterans over the past decade forecasting its demise, this cryptocurrency poster child not only endures but also continues to be a lucrative choice for many investors.

With this remarkable track record and the ongoing shifts in the crypto landscape, predictions for the industry's future hold the promise of captivating twists and turns that are bound to keep enthusiasts and investors alike on the edge of their seats.

The Role of Innovation in Sustaining the Crypto Industry

In the crypto market, innovation plays a crucial role in driving growth. New ideas aimed to satisfy users' necessities reshape how cryptocurrencies work. Innovation keeps the market evolving from better ways to secure transactions to creating platforms for new types of applications.

These changes attract more people and businesses to get involved, leading to broader adoption and higher value for cryptocurrencies. It's like a cycle: as innovation happens, more interest follows, leading to more creation. So, without innovation, the crypto market wouldn't be where it is today.

Risks in Cryptocurrency Investments

Like any asset, cryptocurrencies are susceptible to market changes. We've seen how a surge in general fear towards a particular crypto asset can impact its price.

This happens because when crypto holders anticipate a shift in their token's value, it triggers massive sell-offs, causing the crypto's value to plummet. As an individual investor, there isn't much you can do about widespread fear, but you can adopt several healthy habits to manage risk while trading or holding cryptocurrencies.

For instance, you limit your investments to what you can afford to lose, diversify your portfolio, and avoid putting all your funds into a single cryptocurrency, even if it's promoted as a stablecoin. Remember that the supposedly U.S. dollar-backed stablecoin TerraUSD experienced a significant fall, resulting in substantial losses for its holders.

Volatility of the Market

Giving control of finance to the people comes with its challenges. And it comes to crypto markets volatility. These unstable and risky qualities assigned to crypto assets are unrelated to decentralized systems' failures. The emotional tide of the crypto community often drives volatility.

When massive panic breaks, it can trigger a frenzy of fear-based selling, sending crypto assets on a rollercoaster ride. But this doesn't mean crypto is going to die; it is just a characteristic of the community’s general mentality you should be prepared for if you plan to take your first crypto steps.

Regulatory Challenges

The potential impact of governmental regulations on cryptocurrencies is a topic of significant discussion, with regulatory bodies striving to catch up with the rapidly advancing technology they seek to oversee.

Different countries are adopting varying approaches to cryptocurrency regulation. Some nations like Japan and Switzerland have already introduced or revised legislation concerning crypto assets and related service providers. On the other hand, countries such as the European Union, United Arab Emirates, United Kingdom, and the United States are in the process of formulating regulations.

However, this disparity in regulatory efforts and the lack of uniform understanding within the global crypto community has sparked uncertainty and caution. Many groups in the crypto space are skeptical, highlighting the need for regulatory authorities to thoroughly educate themselves about cryptocurrencies and Web3 technology to produce meaningful regulations effectively.

Conclusion

The crypto world is constantly changing due to innovations, state regulations, and market flows. While challenges like market volatility and regulatory uncertainties persist, the evolution of cryptocurrencies remains steady.

From Bitcoin's revolutionary inception to the rise of altcoins, DeFi, and NFTs, the industry has defied skeptics and adapted to every economic climate. As the world becomes increasingly familiar with digital finance, the future holds promise for captivating twists and turns that will keep enthusiasts and investors engaged.

The enduring resilience of Bitcoin and the ongoing shifts in the crypto landscape remind us that crypto is not dead or even near to it. The symphony of cryptocurrencies continues, offering new possibilities, financial autonomy, and a remarkable revolution in the way we understand and interact with money.